|

A company merges with, or acquires other companies, to realize identified benefits – growing the business, gaining new or complimentary product lines, and expanding into new markets. This merger and acquisition (M&A) activity makes sense when the benefits outweigh the costs. To determine all the costs, the acquiring company’s M&A team completes a review of the company to identify potential liability. When it comes to trade activity, risk and liability are not always obvious. And since most M&A happens with limited review and few people involved, it’s not reasonable to do a complete audit and analysis before closing the deal. The good news is that M&A teams can learn a lot by asking the right questions about trade activity. While this article suggests some steps that should be taken before a purchase, it is always recommended that a complete trade assessment be completed as soon as possible after the closing. A common merger practice is to set a reserve fund for unforeseen regulatory issues and fines. This may work in many cases and makes the M&A team feel like they’ve put “insurance” in place. However, M&A integration periods are a particularly vulnerable time for companies where employees of the acquired company are often let go or decide to leave. This can increase the likelihood of whistle-blower reporting and Customs inquiries. And under certain provisions, Customs pays individuals a large percentage of fines collected which provides a monetary incentive for going after non-compliance. Ultimately, if Customs finds your company responsible for the acquired company errors, it will also impact your legacy operation with heightened auditing and scrutiny. The bottom line is that you don’t want to try to assess and back-fill your trade program compliance capability during a Custom’s inquiry. Customs auditors are experts and will immediately understand that you failed to do due diligence. So how can your M&A team address international trade? For starters, all M&A staff evaluating trade activity should understand and ask the following questions. And ask appropriate follow up questions based on the responses.

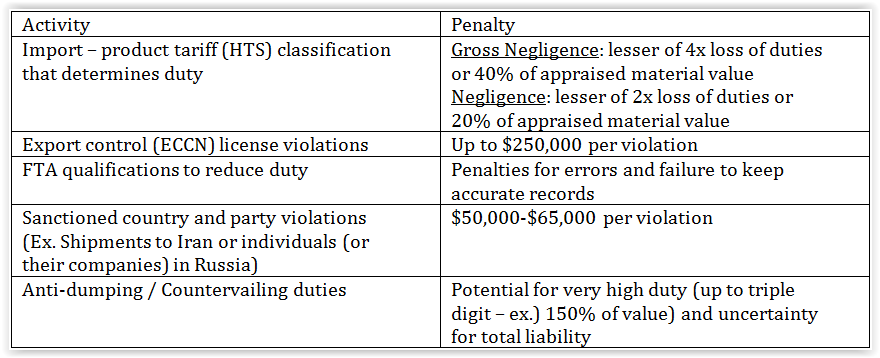

What to Expect from the M&A – the Good and the Bad As with most activity, you can expect to identify some good and bad aspects related to a company’s trade activity. First the Good A company set up to do regular international trade has generally worked through the requirements. If they have dedicated staff identifying key trade data like tariff codes, country of origin, and import and export controls, then they may be compliant, or more compliant, than a company without dedicated resources or one that relies only on external third party companies to facilitate shipments. If you learn that the company has written trade policies and procedures, then you can assess that they have put a foundation in place upon which they can build a compliant trade program. But as with most corporate policies, they are only as good as the processes which are actually followed. And even the most documented processes can fall short of compliance if they are not evaluated through internal audits. The M&A review can uncover the general state of the trade data listed under point 7 above. If a company can demonstrate a complete product database that includes trade data associated with all imported or exported material, then you know that they put the effort into identifying and populating the data. While you most likely won’t be able to evaluate the data for accuracy, companies that aren’t compliant tend to have big gaps in their trade data and this is a red flag indicating higher risk for violations. Companies that take advantage of free trade agreements (FTA) and duty drawback pay less duty. Free trade agreements have very specific requirements that must be met. The burden is on the company to qualify their product under an FTA. Duty drawback lets a company recoup duty paid for imported material that is later exported. Both of these programs require a well-defined written process. If a company responds that they support these programs, then a follow up review of the processes can help determine if they are likely to be compliant. Alternatively, companies that do a lot of importing from countries that have FTAs in place with the US, but don’t claim FTA benefits, may be able to retroactively claim significant duty reductions and be reimbursed for qualified duty discounts. The same is true for duty drawback and large importers or exporters have been known overpay duties in the millions of dollars. These types of savings can easily pay for assessing the acquired company and putting best practice trade processes in place. But making these claims is time sensitive and usually limited to a one year look-back. Another upside of mergers can include merging with a company that has industry best practices in place with the staff to support them. If your company lacks due diligence in some areas, acquired trade staff can help back-fill your processes during the integration. But first you must know your own company’s capabilities. It is recommended that you leverage a trade compliance integration specialist to help support this process. There are many more positive aspects of mergers such as identifying best practices of data management, learning of new third party companies for import brokers and export freight forwarders, and how compliance has been facilitated throughout the supply chain. It’s a time of great opportunity that goes beyond the expected merger benefits. Now the Bad The US Customs laws, and those of most other countries, have a 5 year statute of limitations, with the common violations and potential penalties identified below: The downside reality is that most companies that engage in international trade probably have some existing violations that can be discovered. For the acquiring company, this means you are now responsible for up to five years of potential liability. When going into complete an M&A review, it’s important to understand each of these areas and how to identify potential red flags. For this article, we can provide a high level look at the common areas to learn what it is and the likely red flags.

Product tariff classification: First is product identification using the import harmonized tariff system (HTS) or export schedule B. The focus is on import HTS as that’s what drives duty and is Customs’ primary focus. All material must be classified and a company following best practices can provide a written procedure, product database of classified material, including classification justifications, and plan for annual update reviews. Red flags include not having written processes or audit plan, not being able to produce HTS data, or relying instead on third party companies or product vendors for classifications. Export control (ECCN) classification and licenses: All exported material must be classified for US export controls (or similar controls for other countries) to identify sensitive material (Ex. can also be used for military purposes) and those that require an export license before shipment. Classification requires reviewing the product design and specifications against the regulations. There is no other way to make the determination. Red flags include no ECCN data for export products, all exports being identified as not controlled (EAR99), or relying on third party companies to identify controls. Related to this is technology controls and if a company has export controlled product, then follow up must be made to understand if any employees are restricted from accessing the actual product technology. FTA qualifications: Free trade programs require product qualifications that must be verified each year. Red flags in this area include no written process for qualifying product under claimed FTA, not being able to produce an FTA product database that shows qualifications, and no process for annual updates. With FTA programs uncertain, another red flag may be not having a contingency plan if specific FTA programs go away. Sanctioned country and party violations: Companies that don’t screen their customers, suppliers, and third party service companies risk violating sanctions laws. Restrictions on shipments to some countries and individuals are increasingly complex. Red flags for this area include not having dedicated screening tools, regular screening processes, or no ad hoc screening of new customers, suppliers, and service companies. Anti-dumping / Countervailing (ADD/CVD) duties: This area has been in a state of change since President Trump took office. Failure to maintain a process by which all classified imported material is scrutinized for potential ADD/CVD duties represents a very risky import practice. The red flag is no knowledge of whether goods fall under ADD/CVD. As critical is whether any product is currently under ADD/CVD bond pending a final order determination. In this case, further review should be completed to identify potential liability. Conclusion The more information your M&A team gathers on the current state of the acquired company trade program, the better understanding of potential risk and liability you can establish. Trade information can be gathered through focused questions and requests for key trade data. High level analysis can identify red flags that provide a path to direct follow up or document potential risks and liability. Starting the review during the M&A process increases the likelihood of discovering issues early. This provides a benefit as Customs (imports) and the Bureau of Industry and Security (exports) aggressively mitigates most penalties for companies that voluntarily disclose errors. Being proactive ensures that you reap the benefits of the M&A while limiting the downside risks associated with international trade.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorAdam Palmer - helping importers and exporters remain compliant. Archives

November 2021

Categories |

Copyright Trade Compliant Inc 2023

RSS Feed

RSS Feed